The solar Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000% – creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process. In 2015, SEIA successfully advocated for a multi-year extension of the credit, which has provided critical stability for businesses and investors. Despite the overwhelming success and popularity of the ITC, the value of the credit will unfortunately start decreasing after 2019.

SEIA also supports legislation that would extend benefits of the Investment Tax Credit to energy storage. Click here to learn more.

Quick facts

- The ITC is a 30 percent tax credit for solar systems on residential (under Section 25D) and commercial (under Section 48) properties. The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

- The residential and commercial solar ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006, with an average annual growth of 50% over the last decade alone.

- Congress passed a multi-year extension of the ITC in 2015:

- Eligibility for the ITC is based on a “commence construction” standard. The IRS issued guidance in June 2018 that explains the requirements taxpayers must meet to establish that construction of a solar facility has begun for purposes of claiming the ITC.

- The 2015 extension of the ITC has provided market certainty for companies to develop long-term investments that drive competition and technological innovation, which in turn lowers energy costs for consumers.

- Despite progress, solar energy still only represents 2.5% of energy production in the United States.

- Moving forward, a tax policy that continues to provide stability and investment opportunity for solar energy should be a part of any national discussions about tax, infrastructure, or decarbonization.

Impact of the Solar ITC

The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. Solar deployment, at both the distributed and utility-scale levels, has grown rapidly across the country. The long-term stability of this federal policy has allowed businesses to continue driving down costs. The ITC is a clear policy success story – one that has resulted in a stronger and cleaner economy.

How Does the Solar Investment Tax Credit Work?

The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit.

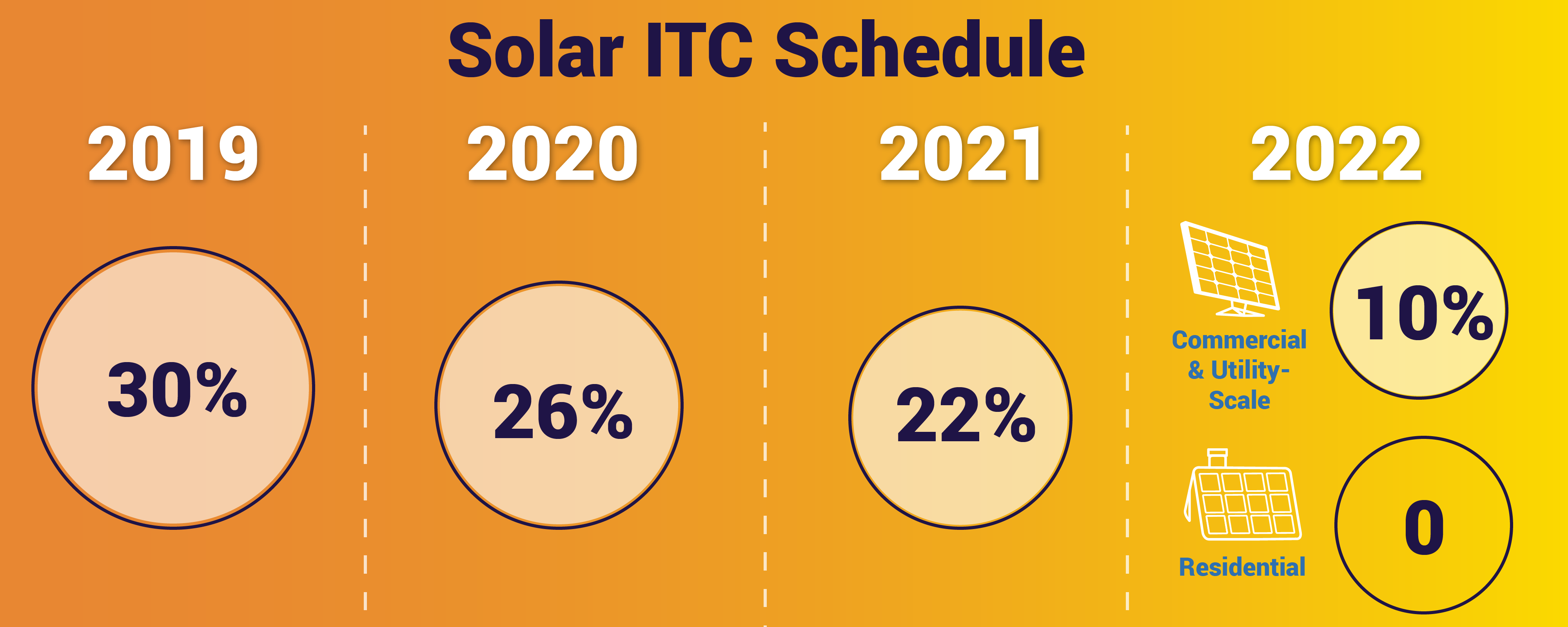

A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Both the residential and commercial ITC are equal to 30 percent of the basis that is invested in eligible solar property which has begun construction through 2019. The ITC then steps down according to the following schedule:

- 26 percent for projects that begin construction in 2020

- 22 percent for projects that begin construction in 2021

- After 2021, the residential credit drops to zero while the commercial credit drops to a permanent 10 percent

Commercial and utility-scale projects which have commenced construction before December 31, 2021 may still qualify for the 30, 26 or 22 percent ITC if they are placed in service before December 31, 2023. The IRS issued guidance (Notice 2018-59) on June 22, 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.